Fundraising enables startups to secure the capital they need for customer discovery, product development,talent recruitment and scaling up operations - all of which are critical to success.

But, how does fundraising work? How do you find investors? These are complex questions that do not have universally valid answers. Many factors, including the degree of maturity of the startup and its sector, can play a role in determining the best fundraising strategy.

While searching for universally valid answers, we came across a particularly interesting piece of content published by Y Combinator.

Let's try to summarise the key points together.

Y Combinator's advice for startups seeking funding

Y Combinator (YC) is a startup accelerator based in USA founded in 2005. Its transparent and constructive approach, combined with its commitment to fostering innovation, has earned it the trust of the international business community. The numerous unicorns and thriving companies born from its programmes are a compelling testament to its credibility and effectiveness.

YC has helped more than 2,000 companies and has thus become a benchmark for both aspiring entrepreneurs and experienced founders.

7 myths to dispel about fundraising for startups

Brad Flora, partner at YC Group, has participated in and followed several fundraising ventures in multiple roles: as a founder, as an angel investor and as a partner at YC Group. Who better than him can help us dispel the most common myths related to finding investors for startups?

1 - Fundraising is a glamorous activity full of glamour and sequins

Fundraising for startups may sound glamorous, but the reality is quite different. In some TV programmes such as Shark Tank, the process is presented as very short and high-pressure. Entrepreneurs present their business idea to potential investors in three minutes and make it sound like a glamorous event, where everything is on the line in a few moments...

Fundraising actually involves many one-to-one meetings and long chats in informal settings. Perhaps over a coffee and usually away from the red light of the camera.

The pitch competitions and business plan events seen in Shark Tank serve mainly for show and marketing purposes. In truth, fundraising is hard work, with founders meeting potential investors in person or by video chat and trying to convince them to invest.

It usually takes several months to raise the necessary funds.

2 - You need to raise money before you can start working on your startup

A common myth in startup business is the belief that you need to raise money before you can start working on your start-up. However, successful founders approach fundraising differently. They focus on building the first version of their product, even if it is only a prototype, and on acquiring users. Only then do they start looking for funding.

Building a prototype or hosting a website has become cheaper and easier over the years, and finding potential users is also more accessible through platforms such as Product Hunt and social media.

By having a product and a user base, founders attract investors who prefer established startups. For example, Solugen, a chemical production start-up, began by building a scaled-down version of its reactor capable of producing and selling hydrogen peroxide. Revenues were generated by selling hot tub supplies to shops.

Investors were more inclined to back Solugen because it had made progress and demonstrated market potential. They eventually raised $400 million and scaled their business.

3 - My startup must impress investors!

Believing that a startup needs to be impressive to raise funds is not true. More than impressing investors, it is necessary to convince them that it is a good project.

Many successful start-ups initially seemed 'terrible', but forward-looking investors smelled their potential and believed in the project.

You don't need magic words or fancy talk: you need to create something that people want and explain how it can become a success.

One example is Retool, a company that raised funds by simply showing investors their software and talking about its value to customers. They did not try to impress or impress, they simply explained and convinced.

4 - Raising funds is complicated, slow and expensive

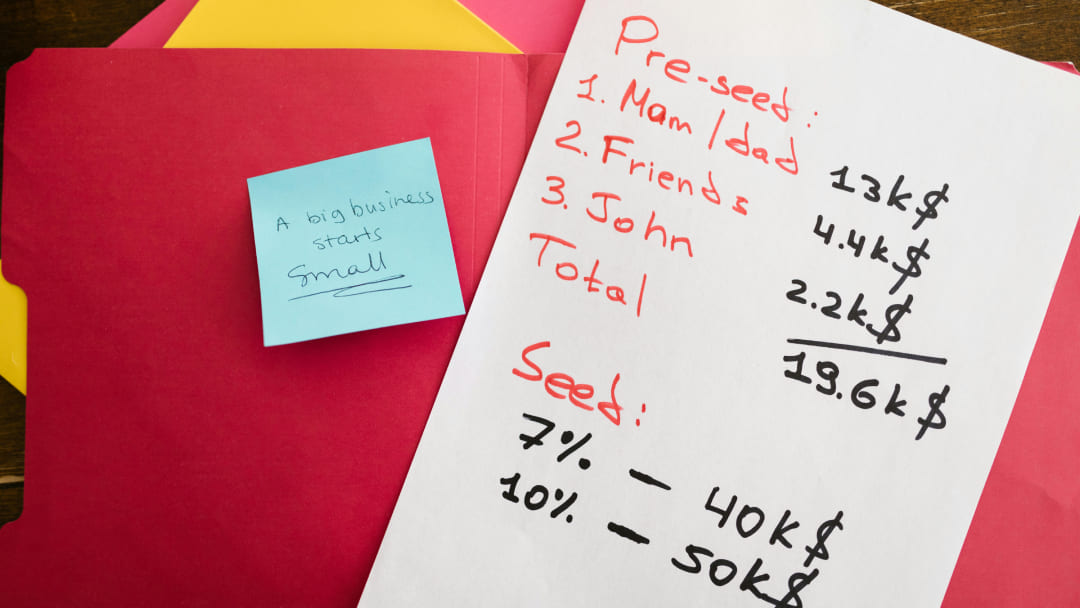

Fundraising for startups can seem complicated, slow and expensive. And sometimes this is true, especially if you only read the news about large funding rounds. However, these large rounds are not the norm for most startups. The reality is that early-stage funding, such as seed rounds or raising money from friends and family, can be much smaller and faster.

In 2013, Y Combinator created a standard fundraising document called SAFE (Simple Agreement for Equity), which simplified the fundraising process.

The SAFE is a short document that is easy to understand and can be closed quickly without the need for expensive lawyers. It regulates a pact between investor and startup: whoever makes an investment in a company will get its shares or stock at a later date. That is, when a certain event occurs that allows new liquidity in the company (capital increase, sale of shares or new financing).

Since June 2023 the Italian SAFE is also a reality, thanks to the collaboration between Italian Tech Alliance, Growth Capital and the law firms Portolano Cavallo and Linklaters Italia.

This type of fast and cheap fundraising gives founders more leverage when talking to investors. For example, biotech startup Azure Bio was able to raise its first $1m using SAFE. This accelerated its progress and allowed it to gain more leverage and credibility as it became solid and mature and approached more structured investors. Fundraising for start-ups does not have to be complicated and slow.

5 - Having investors will make me lose control of the company

Raising money for your startup does not mean losing control of it. On the contrary, founders today have more control over their companies than ever before. Often, when you raise money through seed rounds, you don't give up any board seats. This means you can build your company any way you like and not answer to anyone but your customers.

Let's take the example of Zapier, a successful start-up that raised money at the beginning of its business and while it grew it maintained control of its company by providing solutions to thousands of customers.

Consider raising money early and not having to do it again, as Zapier did. You will have more control and can focus on keeping your customers happy.

6 - Raising money requires a high-level network of acquaintances

Raising money for startups does not require a 'fancy' network of acquaintances. The reality is that investors care more if the product is desired by people, rather than your background or knowledge.

Take the example of Podium, a company that started out producing software for tyre shops. The founders did not have a network of contacts in Silicon Valley, but they succeeded because they created something that people wanted. They managed to raise funds and now the company earns millions of dollars.

7 - If investors refuse funding, the startup idea is no good

If investors refuse to fund your startup, it doesn't mean that the idea is bad.

The truth is that even great products and successful companies are rejected by investors. Just think of Envision, a medical device start-up that was rejected more than 50 times before it got funding. It was eventually acquired for millions of dollars. The key is to believe in your product and keep going, even in case of rejection.

Rejection is a step in the process towards success

There is no set path to success. So, if you are wondering whether the start-up world is really for you, remember that the common denominator of these myths we have tried to dispel is the misleading idea that only a privileged few can succeed. The reality is that there is no magic formula or path reserved for a select few.

Anyone with the right skills and character traits can think about creating a startup and raising capital to grow it. Remember, you don't need anyone's permission to start your entrepreneurial journey. The key is to create something that people want and to be able to communicate your vision authentically.

To learn more about Brad Flora's advice, we recommend watching the video How Startup Fundraising Works | Startup School. If your startup has not yet been mapped on Torino Tech Map join the Turin innovation ecosystem.